-

ROSSLARE EUROPORT TARGETS HEALTH & SAFETY WITH CAMERA TELEMATICS PARTNERSHIP - 2 days ago

-

Landmark Study Reveals Wearable Robotics Significantly Boost Safety and Efficiency in Industrial Environments - July 24, 2024

-

Visku Tackle The Retail Seasonality Challenge One Pallet At A Time - July 22, 2024

-

KAMMAC AND BERGEN LOGISTICS STRENGTHEN FASHION & LIFESTYLE SERVICES IN THE UK - July 19, 2024

-

TENTBOX EXTENDS PARTNERSHIP WITH ARROWXL TO SUPPORT INCREASING DEMAND - July 17, 2024

-

The Perfume Shop improves customer journeys while driving profitability in partnership with Scurri - July 17, 2024

-

ZEROMISSION SECURES £2.3M ($3M) INVESTMENT TO ACCELERATE ELECTRIC FLEETS - July 16, 2024

-

BCMPA CELEBRATES SUCCESS OF 2024 CONFERENCE - July 15, 2024

-

Best of the Best: Jungheinrich Celebrates Triple International Award Win - July 12, 2024

-

GOPLASTICPALLETS.COM CALLS ON NEW CHANCELLOR RACHEL REEVES TO CONSIDER PLASTIC PACKAGING TAX REFORM - July 10, 2024

Dash For Brexit Stockpiling Space Will Have Adverse Tax Consequences

Surging demand for space to stockpile supplies ahead of Brexit at a time of profound structural change taking place across the retail sector with the unstoppable rise of discounters and online retailers has fuelled unprecedented demand for warehousing culminating in a race for new ‘state of the art’ super sheds according to a report from real estate adviser, Altus Group.

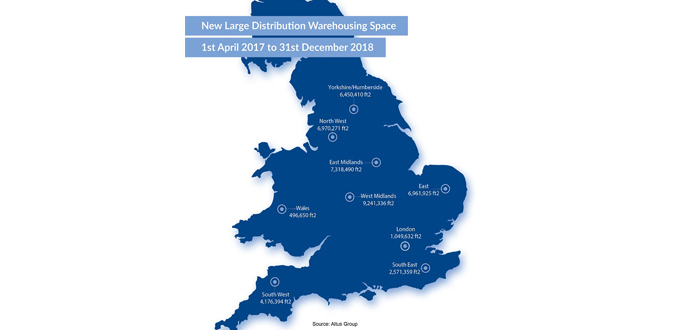

A mammoth 45.24 million square foot of brand new large distribution warehousing space has been built in England and Wales since April 2017 – the equivalent of 589 full size football pitches.

15% of that space, 6.88 million square foot, was for the online retail giant Amazon with grocery discounters Aldi and Lidl also taking significant new space for its distribution facilities.

Altus Group say 159 brand new large distribution warehouses, super sheds which are bigger than 85,000 square foot, have been built and added to the local Rating Lists between 1st April 2017 and 31st December 2018 with overall numbers up 7.3% in just 21 months.

Over a third of all new capacity has been built in the Midlands. 9.24 million square foot of vast sheds, the biggest amount of new warehousing, was added in the West Midlands with an additional 7.32 million square foot in the East Midlands.

Robert Hayton, Executive Vice President at Altus Group says “traditionally, the Midlands generally has always been at the centre of distribution, mainly because of the road network and availability of land. This is continuing with a proposed extension of Magna Park in Lutterworth as well as the continued expansion at Dirft and Birch coppice near Tamworth.”

Clocking in at 2.2 million square feet – Tilbury is Amazon’s largest ‘fulfilment centre’ home to the etailer’s latest robotic technology and the biggest of all the brand new sheds.

The cost of warehouse space rose by as much as a quarter in the final three months of 2018 as fears of a no deal Brexit exacerbated capacity problems already caused by rising demand from online retailers and the grocers.

1st April 2019 is the date at which rental levels are looked at again in determining rateable values for the next revaluation of business rates in 2021 which will then be used to determine tax bills between 2021 and 2024.

Hayton added “Stockpiling for Brexit may have been the prudent thing to do with all the uncertainty but there could well be tax consequences given the effect it has had on rents.”

Large distribution warehouses in England and Wales will pay £789.15 million in business rates for 2019/20 around 3% of the total amount to be collected.